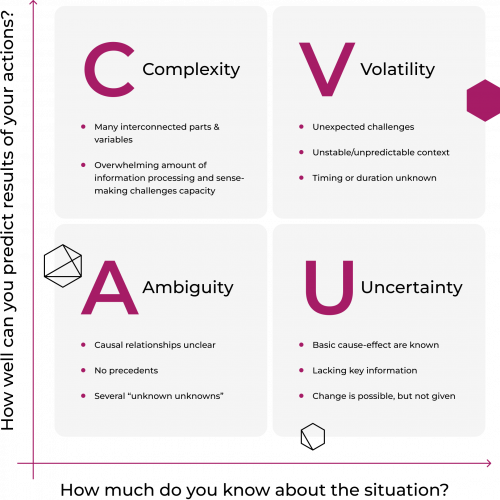

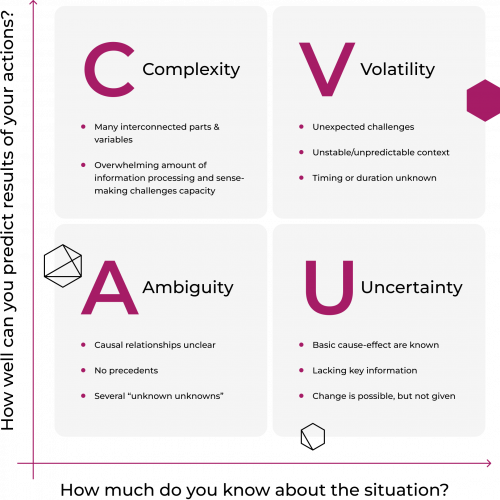

VUCA Analysis

VUCA (volatility, uncertainty, complexity, and ambiguity) analysis is a framework used to characterize the ever-changing, unpredictable world that we live and work in. A VUCA analysis is designed to illustrate the unpredictable nature of everything. In doing so, sectors of VUCA are used to enrich foresight and insight and the behavior of individuals and organizations in strategic planning.

Companies can benefit from using VUCA by gaining insights into the complexity of the environment they operate in, allowing them to be better prepared for any potential risks, as well as striking when the iron is hot on any potential opportunities.

VUCA analysis can be done through examining different questions such as what are the trends in the industry currently? Who are our competitors? What resources do we have access to? By evaluating these questions and more, companies can build a comprehensive understanding of their external environment and develop strategic plans accordingly.

However, traditional VUCA exercises are done manually, often on a physical or digital whiteboard, and often in groups which can lead to certain types of bias. Fortunately, the advantages of Quantumrun’s version of VUCA include:

- The ability for your team to source trend insights from the Quantumrun platform;

- Facilitating a blind vote for each VUCA topic in the project so that its graph position represents the team’s unbiased, collective perspective;

- Positioning each topic by its average impact and likelihood scores as assigned by your team (e.g., instead of positioning a topic randomly inside a VUCA quadrant, as is common in whiteboard/paper exercises.)

How to conduct a VUCA analysis

Choose an organizational leader who can facilitate a discussion with multiple participants. You want an individual who will ensure that all participants are heard in the discussion.

Tip: If your organization is interested in an external facilitator, we can assist you.

Work with your team to identify the perceived volatilities for your organization. Volatility describes a relatively unstable change. For example, price fluctuation after a natural disaster, such as when a flood affects your supply chain.

During your Volatility analysis, consider asking some of the following questions:

- What are possible unpredictable changes that might affect us?

- How might different sectors change how we operate?

- How might the environment affect our company’s inner workings?

Work with your team to identify the perceived uncertainties for your organization or for a specific project, department, or service. Uncertainty describes the lack of predictability and the possibility of surprise for your organization or project. For example, a government’s policy change can change the future of the business and the market.

During your Uncertainty analysis, consider asking some of the following questions:

- What are possible (international) political decisions that could affect us?

- How might the stock market fluctuation affect us?

- What else is perceived as unknown for the organization?

Work with your team to identify the perceived complexities for your organization or for a specific project, department, or service. Complexity describes the multiplex of forces, the confounding of issues, and possible confusion that may affect the organization. For example, the company operates in multiple countries, where they have to navigate different regulatory environments and tariffs.

During your Complexity analysis, consider asking some of the following questions:

- Do we have multiple operations, projects, or services that are viewed as complex?

- How are our employee and employer dynamics?

- Are there other difficult-to-understand aspects of a problem?

Work with your team to identify the perceived ambiguities for your organization or for a specific project, department, or service. Ambiguity describes unclear relationships and the potential for misreads. For example, there may be a lack of clarity from upper management which may lead to the mismanagement of funds.

During your Ambiguity analysis, consider asking some of the following questions:

- What is the possibility of misunderstanding and confusion?

- How can directions be issued more clearly?

- What signifies that more information is needed?

After identifying your VUCAs your team can begin to outline a strategic plan and action items/initiatives to tackle each sector of the analysis.

When would you use a VUCA instead of SWOT graph?

VUCA (Volatility, Uncertainty, Complexity, Ambiguity) is used to describe and understand the nature of the rapidly changing and unpredictable world.

SWOT (Strengths, Weaknesses, Opportunities, Threats) is used for analyzing and understanding the internal and external factors that may impact an organization’s success.

SWOT is best used when the situation is relatively stable and well-defined, while VUCA is more relevant in situations where rapid change and unpredictability are present.