Banking industry trends 2023

This List covers trend insights about the future of Banking industry, insights curated in 2023.

This List covers trend insights about the future of Banking industry, insights curated in 2023.

Signals

Thepaypers

Switzerland-based software company Netcetera has invested in its digital banking offerings and in the expansion of its product portfolio in the region. As Netcetera's digital banking solutions are offering both custom development and standard products, customers, banks, and financial institutions will be able to leverage its service modules while having the possibility to add customised and personalized additional functionality to them as well.

Signals

Adlittle

Home Industries Aerospace & Defense Automotive Chemicals Consumer Goods & Retail Energy & Utilities Financial Services Healthcare & Life Sciences Industrial Goods & Services Oil & Gas Private Equity Public Services Telecommunications, Information Technology, Media & Electronics (TIME) Travel & Transportation Services Corporate Finance Digital Shift Digital Problem Solving Information Management Marketing & Sales Operations Management Organization & Transformation Risk Strategy Sustainability Technology & Innovation Management Insights Prism Reports Viewpoints Service Industry See all Insights SPACE About History Leadership Locations Press Careers Our Culture Your Career Learning and Development Our People Working with Purpose Behavioral Interview Case Interview Case Study.

Signals

Financialit

"BaaS" is an acronym increasingly used in the financial sector. But what exactly is it? What is Banking as a Service? What opportunities does it offer to banks? What technical constraints does it create? All the answers are in this article! Banking as a Service or BaaS: how does it work? Banking...

Signals

Itchronicles

It's no secret that the traditional banking industry has been around for ages, and while it has served us well over the years, it's no secret that it's time for a change. Enter FinTech - the new kid on the block making waves in the financial world. . From online and mobile banking to AI and Blockchain Technology, FinTech is taking the banking industry by storm and transforming how we manage our finances.

Signals

Financialit

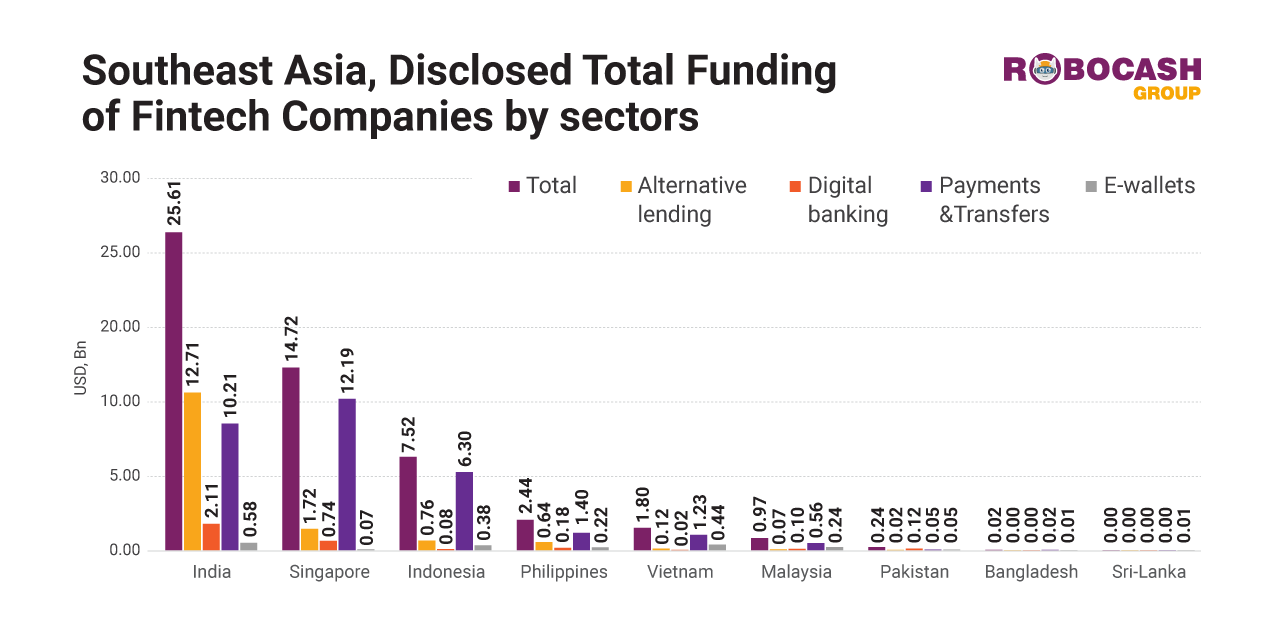

South&Southeast Asia Fintechs Have Raised USD 53.3B to Date in Alternative Lending, Digital Banking, Payments & Transfers, and E-wallet Over the entire history, fintechs in alternative lending, digital banking, payments & transfers, e-wallet sectors have raised a grand total of USD 53.3 Bn and...

Signals

Forbes

Argentina is looking to China to avert a sudden devaluation.Getty Images

As it looks to shore up its foreign exchange reserves in the midst of triple digit inflation, the Argentine government secured some $1 billion in financing from Chinese companies. These announcements, occurring in the midst...

As it looks to shore up its foreign exchange reserves in the midst of triple digit inflation, the Argentine government secured some $1 billion in financing from Chinese companies. These announcements, occurring in the midst...

Signals

Tripwire

Cybersecurity has risen to become a major concern for nearly every industry. With the constant stream of news about the escalating numbers of breaches, it is understandable that governments have taken a more active role by passing cybersecurity and privacy legislation. Some of the industries are...

Insight posts

Quantumrun Foresight

Banks that fail to adequately account for their financed emissions risk promoting a high-carbon economy.

Signals

Pymnts

A changing financial industry is transforming the relationship between traditional banks and FinTechs. In the past, banks largely regarded FinTechs as formidable competitors, if not existential adversaries, due to the latter's technological prowess, agility and superior customer experiences. This dynamic, however, has begun to swing toward collaboration as both sides adjust to economic pressures, regulatory concerns and evolving customer preferences.

Signals

Investmentpedia

The landscape of banking has undergone a remarkable transformation over the years, driven by advancements in technology and changing customer demands. Traditional banking services have embraced digital platforms, enabling customers to access their accounts, make transactions, and manage finances with unparalleled convenience.

Signals

Bankingblog

Unless you've been living under a rock for the past few years, you're aware that global trade and supply chains have been facing a series of challenges, from lockdowns to inflation, from geopolitical upheaval to the transformational power of generative AI. Are these short-term challenges for the...

Signals

Becominghuman

AI has a wide range of applications in banking, from improving customer experiences to enhancing risk management and complying with regulatory requirements. As AI continues to evolve, we can expect more innovative solutions to help banks and financial institutions provide better customer services and stay ahead of the competition.

Signals

Computerweekly

The Joint Regulatory Oversight Committee (JROC) has said set out its next steps, following recommendations made in April, to grow the open banking sector in a "safe, scalable and economically sustainable way". In April's announcement, the JROC, which replaced the Open Banking Implementation Entity (OBIE) - set out key steps.

Signals

Bankingblog

With Open Banking evolving into Open Finance around the world, it has been difficult to gather the necessary data to track its progress and see the patterns evolving in different regions. Thanks to Open Banking Excellence, that data has been gathered and analyzed in a new report, The Open Finance...

Signals

Fintechfutures

Banking tech heavyweight Tata Consultancy Services (TCS) has signed Sweden's Ikano Bank for its flagship TCS Bancs core banking system. The solution will be delivered on a Software-as-a-Service (SaaS) basis and will support the bank's pan-European core banking modernisation. Started by the founder of IKEA, Ingvar Kamprad, Ikano Bank operates in eight markets - Sweden, Norway, Denmark, Finland, Germany, Poland, the UK, and Austria - and is part of the Ikano Group, which owns 51% of the bank.

Signals

Pymnts

The Middle East and North Africa (MENA) region is quickly becoming a hotbed for open banking, driven by a unique ecosystem, booming consumer demand and "forward-thinking" regulators, said Abdulla Almoayed, founder and CEO at Tarabut Gateway. . Earlier this month, for example, Tarabut Gateway received its open banking certification from the Saudi Central Bank (SAMA) to launch its open banking services within the Regulatory Sandbox in the Kingdom of Saudi Arabia (KSA).

Signals

Consumerfinance

New digital banking technologies have the power to expand and open market access for American consumers and emerging businesses. In a more competitive market, Americans will be able to earn higher rates on their savings, pay lower rates on their loans, and more efficiently manage their finances....

Signals

Computerweekly

US retail bank Citi is rolling out technology that will enable its US Personal Banking business to offer customers highly personalised services whether they walk into a branch, use a mobile banking app or phone a call centre. US Personal Banking, which provides debit and credit cards, retail financial services and retail banking to US customers, contributes over $10bn in revenue to Citigroup.

Signals

Ffnews

Paris-based payment processor Score & Secure Payment (SSP) has partnered with Europe's leading open banking platform, Tink, to enhance its payments solution across Europe.

SSP, who specialise in account-to-account payments with over 14,000 merchants in Europe, will use Tink's Payments technology...

SSP, who specialise in account-to-account payments with over 14,000 merchants in Europe, will use Tink's Payments technology...

Signals

Jdsupra

Following the publication in April of its recommendations for the next phase of Open Banking in the UK, the Joint Regulatory Oversight Committee (JROC) has now set out an 'ambitious programme of work' to take those recommendations forward. This work includes the creation of two regulator-led working groups to develop the framework for the expansion of variable recurring payments (VRPs) and the design of the Future Open Banking Entity.

Signals

Computerweekly

Keytrade Bank is moving from legacy core banking technology to a cloud-based platform from Infosys's Finacle subsidiary in a move that will help it "leapfrog" in-house development. The Benelux-based online bank, with operations in Belgium and Luxemburg, is replacing its legacy core banking system with Infosys Finacle's core banking software as a service, hosted in the public cloud with Microsoft Azure.

Signals

Paymentsdive

Dominant payments players and financial services companies will not have leeway to dictate the terms of open banking in the U.S., Consumer Financial Protection Bureau Director Rohit Chopra made clear in a post on the agency's website Monday. The CFPB, which polices and regulates the financial services market, is preparing to issue a rule proposal with respect to open banking later this year.

Signals

Jdsupra

On June 2023, federal banking agencies issued final Interagency Guidelines on Third-Party Relationships detailing their expectations for banks in establishing risk management practices with third-parties—including fintechs. This final guidance from the Federal Reserve, Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of Currency (OCC) replaces previously issued general guidance for each agency's supervised banking organizations.

Signals

Nzherald

New Zealand's banking sector is next in line for a Commerce Commission market study.The Government has directed the agency to investigate the competitiveness of the sector, dominated by four big Australian-owned banks - ANZ, ASB, BNZ and Westpac.The Government wants the Commission to focus on...

Signals

Prnewswire

Expansive digital transformation helps community bank innovate forward

PLANO, Texas, June 20, 2023 /PRNewswire/ -- Alkami Technology Inc. (Nasdaq: ALKT) ("Alkami"), a leading cloud-based digital banking solutions provider for banks and credit unions in the U.S., announced today that Texas-based...

PLANO, Texas, June 20, 2023 /PRNewswire/ -- Alkami Technology Inc. (Nasdaq: ALKT) ("Alkami"), a leading cloud-based digital banking solutions provider for banks and credit unions in the U.S., announced today that Texas-based...

Signals

Finance

The report shows that most banks are not planning to curb tech spending in the near future, with cybersecurity being chief among their concernsNEW YORK, June 13, 2023 /PRNewswire-PRWeb/ -- An annual report from Arizent, parent company of American Banker, an information resource for decision...

Signals

Forbes

Tim Cook, chief executive officer of Apple Inc., beside an Apple Vision Pro mixed reality (XR) ... [+] headset during the Apple Worldwide Developers Conference at Apple Park campus in Cupertino, California, US, on Monday, June 5, 2023. Apple Inc. will charge $3,499 for its long-awaited...

Signals

Ffnews

Spense, a leading Norwegian payment solution that focuses on creating innovative customer journeys within the automotive industry, has partnered with Neonomics to offer open banking payments. Through this partnership, Spense has now further developed the customer journey to provide open banking...

Signals

Business-money

SAP Fioneer launches tailored SME banking offering SAP Fioneer, a leading global provider of financial services software solutions and platforms, has announced the launch of its Fioneer SME Banking Edition. The solution will enable banks and neobanks to offer banking capabilities in a...

Signals

Financialit

NCR Corporation, a leading enterprise technology provider, today announced the successful migration of 24 million NCR DI Digital Banking users to Google Cloud's highly scalable and secure environment.NCR DI Digital Banking's move to the Google Cloud environment benefits this client base of banks...

Signals

Techcrunch

Open banking — where traditional banks enable payments and other new services by way of APIs that give access to financial data previously locked up in their systems — has led to a rush of startups looking to build the links to make it a reality. Today one of the hopefuls in open banking — Volt out of the U.— is announcing a significant round of funding, a sign of growing activity and confidence in the space.

Signals

Jdsupra

Tailored to focus on what is happening today in banking and financial services, this half-day program will take an in-depth look at the prevalent legal ethics issues attorneys of all experience levels encounter. Our faculty of experts come from diverse positions in the industry, and will share from their experience to illustrate common areas of potential ethical risk when working with clients in banking and financial services.

Signals

Theglobeandmail

Open this photo in gallery:Canada may have been ahead of the curve in thinking about the importance of a modern digital payments system, but more than a decade after this warning was issued it is lagging well behind other nations.CHRIS HELGREN/ReutersDavid Dodge is a former governor of the Bank...

Signals

Blockchain

Governor Michelle W. Bowman, a member of the Board of Governors of the Federal Reserve System, emphasized the need for a responsive and responsible regulatory framework in the banking sector. Speaking at an event in Salzburg, she discussed the importance of adapting to changing economic...

Signals

Financialit

Mbanq, the USA-based fintech innovator and global Banking-as-a-Service (BaaS) provider, has announced that Cheqly, a fintech that makes banking simple for startups, has launched utilizing Mbanq's BaaS platform. With this partnership, Cheqly is able to provide its customers with an improved...

Signals

Thepaypers

In the fight against identity fraud in banking, Henry Patishman from Regula emphasises how robust ID verification can enhance security to prevent financial losses while maintaining a positive user experience. Traditional banks are currently undergoing various stages of digital transformation. During this process, they recognise that even the initial phase, which involves remote sign-ups for bank accounts known as digital onboarding, can be enhanced through different approaches.

Signals

Financemagnates

The financial

services business is undergoing a revolution as a result of technological

improvements and shifting customer expectations. Open banking has emerged as a

crucial driver of this shift, transforming how individuals and organizations

access and manage their financial data. Customers...

services business is undergoing a revolution as a result of technological

improvements and shifting customer expectations. Open banking has emerged as a

crucial driver of this shift, transforming how individuals and organizations

access and manage their financial data. Customers...

Signals

Fintechnews

In recent years, the Artificial Intelligence (AI) growth in the finance market has been considerable, with the sector projected to expand to an astonishing US$ 1,591.03 billion by 2030 at a Compound Annual Growth Rate (CAGR) of 38.1 percent.

A study revealed that it is estimated that adopting AI...

A study revealed that it is estimated that adopting AI...

Signals

Analyticsvidhya

Macquarie's Banking and Financial Services Group has joined forces with Google Cloud to harness the power of artificial intelligence (AI) and machine learning (ML) in an exciting collaboration to revolutionize the banking industry. This partnership aims to enhance customer banking experiences by...

Signals

Enterpriseappstoday

Published Via 11Press : According to HTF MI, "Global Cloud Computing in Retail Banking Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023-2029″. The Global Cloud Computing in Retail Banking Market is anticipated to grow at a compound annual growth rate (CAGR) of 13.2%...

Signals

Ffnews

Industry watchdog The Financial Conduct Authority (FCA) has written to banks that lend to UK companies to warn them about "greenwashing" and "conflicts of interest" in the sustainable loans market.sust

The rising popularity of deals that link borrowing costs to sustainability targets has prompted...

The rising popularity of deals that link borrowing costs to sustainability targets has prompted...

Signals

Pymnts

For the payment networks, the reach and scale is there to create new digital platforms for financial institutions — natural extensions of the relationships that are already in place. And along the way, with technological infrastructure and application programming interfaces (APIs) in the mix, a network effect can take shape, globally, as more banking clients use more digitally enabled products and services.

Signals

Centralbanking

The future of payments, like voice-based banking, promises to transform the fintech world as traditional friction barriers begin to disappear. Amid this innovation, concerns arise, addressed here by Seemanta Patnaik, co-founder and chief technology officer at SecurEyes: could the advent of...

Signals

Fintechfutures

Bahamas-based Capital Union Bank has selected Avaloq's Web Banking solution to power its new online banking platform and is set to upgrade its core banking system "with new modules and features based on joint innovation" with the vendor. Capital Union Bank provides execution, custody and lending services to institutional investors, financial intermediaries and ultra-high-net-worth individuals across the world.

Signals

247wallst

Amazingly, 72% of mobile wallet users now say they're comfortable enough in the digital universe to leave their wallets at home and rely on their phones to make payments. Americans have long had a love-hate relationship with digital wallets and banking. They love the convenience but hate the technical issues and the idea of identity theft via hacking.

Signals

Investopedia

What Is an Offshore Banking Unit (OBU)?

An offshore banking unit (OBU) is a bank shell branch, located in another international financial center. For instance, an offshore banking unit could be a London-based bank with a branch located in Delhi. Offshore banking units make loans in the...

An offshore banking unit (OBU) is a bank shell branch, located in another international financial center. For instance, an offshore banking unit could be a London-based bank with a branch located in Delhi. Offshore banking units make loans in the...

Signals

Dandodiary

Over the course of several weeks from March to early May this year, three large U.S. banks failed in a sequence of events that has come to be known as the Banking Crisis of 2023. Fears arose at the time that the bank failures could become a contagion event across the banking industry. With the...

Signals

Ibtimes

The financial industry is in one of the most challenging periods of the 21st century.

AFP News

Traditional banking is facing severe public scrutiny. Rising interest rates, inflation, and events like the Silicon Valley Bank collapse are exposing the weaknesses of banking as it exists today, and...

AFP News

Traditional banking is facing severe public scrutiny. Rising interest rates, inflation, and events like the Silicon Valley Bank collapse are exposing the weaknesses of banking as it exists today, and...

Signals

Nzherald

Why are the banks making open banking so difficult, asks Diana Clement.OPINION

Why are our banks so far behind in providing customers with open banking? It's a service that will improve a range of financial tasks, ranging from remortgaging to budgeting. Other similar countries have had

this...

Why are our banks so far behind in providing customers with open banking? It's a service that will improve a range of financial tasks, ranging from remortgaging to budgeting. Other similar countries have had

this...

Signals

Digitaljournal

PRESS RELEASEPublished June 30, 2023Executive Summary

The Smart Banking Solutions market is expected to grow at a CAGR of 10.6% during the forecast period (2023-2030). The market growth is attributed to the increasing adoption of digitalization and banking automation, coupled with the rising...

The Smart Banking Solutions market is expected to grow at a CAGR of 10.6% during the forecast period (2023-2030). The market growth is attributed to the increasing adoption of digitalization and banking automation, coupled with the rising...

Signals

Financemagnates

Over the last

decade, technological breakthroughs and shifting consumer demands have caused a

remarkable change in digital banking. The rise of neobanks and the integration

of financial services into non-financial platforms, known as embedded finance,

have posed challenges to traditional banking...

decade, technological breakthroughs and shifting consumer demands have caused a

remarkable change in digital banking. The rise of neobanks and the integration

of financial services into non-financial platforms, known as embedded finance,

have posed challenges to traditional banking...

Signals

Business-money

NatWest calls for step change in banks and fintechs' approach to Open Banking In a report published today on 'The (Unmet) Potential of Open Banking', Oxera identifies the key economic obstacles that are holding back the wider adoption of Open Banking and the development of new innovative use...

Signals

Ffnews

HSBC is the first bank to join BT and Toshiba's quantum-secured metro network - connecting two UK sites using Quantum Key Distribution (QKD) to prepare its global operations against future cyber threats. This technology will be trialled in multiple scenarios, including financial transactions,...

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/MKHAB67PIFFRFFQTL2NQ6YVGP4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/tgam/XNPOCKGD55NF5JBPGTNUETXFZ4.JPG)

:max_bytes(150000):strip_icc()/800px-ING_Group_structure-6e6ce02cb1104164b37dd278744adc9b.png)

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/M54L3MTUMNFBZCN447T6OFA5A4.jpg)